Budget 2022: A call for action

- FIC Hansraj

- Jan 30, 2022

- 4 min read

With the recent wave of infections driven by the Omicron variant dampening the hopes of a quick economic resurgence, the much-awaited event in the financial calendar, Union Budget is just a couple of days away. Finance Minister Nirmala Sitharaman is all set to present her 4th budget on February 1. The budget comes in the backdrop of a year that has seen several ups and downs in terms of economic revival.

A sustained decrease in infections and increased pace of vaccinations led the economic revival but some long-standing issues like high inflation rates have continued to ravage the economy. High inflation rates are a major concern as RBI will be forced to increase its interest rates in the near future hampering economic growth. To avoid such volatile interest rates in the future, the government would have to plan a calibrated fiscal policy sustaining growth in the medium and long term. Many economists agree that a calibrated fiscal policy is the key to countering the twin problems of high inflation rates and government debt. The ability to arrive at a consensus by taking into consideration the unique and sometimes even conflicting interests of various stakeholders is the hallmark of an excellent government budget. Indian policymakers continue to push the envelope in this regard each year, in the month of February.

The infrastructure-focused Union Budget of 2021, which proved to be well suited to the then prevailing economic climate, has set the expectations high for 2022. Some of the issues and problems have set the tone for this year’s budget.

1. Following Through: Infrastructure And Disinvestment

Following last year’s infrastructure-focused budget, expectations are there that the government will focus on strengthening the policies implemented so far and increasing the share of capital expenditure in infrastructural development; something which the finance minister has already alluded to in her statements. Another major expectation is carrying forward the ambitious plans of asset monetization announced last year.

There is also speculation that the government is making major efforts to meet the disinvestment target of FY 2021-22 and more focus is being given on the disinvestment of loss-making PSUs.

2. Automobile Sector

The automobile industry, a sector that contributes to half of the industrial production, has been plagued by a global semiconductor chip shortage this year. There is a growing consensus that the industry requires government support via Budget 2022. The sector wants the government to allow direct exemptions and incentives for the use of Electric Vehicles(EV’s). Many production units have also demanded support in domestic chip-building capabilities from the government.

3. Real Estate Sector

As the second-highest employment generator in India, the real estate industry is easily one of the most influential sectors of the Indian economy. It has shown extreme fortitude in the face of the pandemic.

This sector was initially negatively affected by the pandemic owing to a loss in demand caused by a sense of uncertainty. Gradually, it has seen some stability and has taken a positive trajectory which can, nevertheless, succumb to a change in market sentiments if not complemented by the right policies. It is expected that the changes in fiscal policy will stimulate this sector.

One of the most popular demands of people in this sector is raising the ceiling used for the classification of affordable housing from Rs. 45 Lakhs to 80 Lakhs - 1Cr at least in the tier 1 cities. This will expand the segment of consumers that benefit from lower taxation, subsidies, and tax deductions on interest payments.

4. Healthcare

The COVID-19 pandemic has challenged the Indian healthcare system and has highlighted its strengths and weaknesses. The lack of quality infrastructure in this sector is alarming.

The best course of action for stimulating this sector is to incentivize investments by making them tax-deductible; and by lowering credit requirements coupled with Viability Gap Funding. Moreover, government expenditure must also increase to reach the targeted 2.5-3% of GDP by 2024-’25.

Limited accessibility to health insurance was also brought to light during the Coronavirus pandemic, as highlighted by the NITI Aayog report - “Health Insurance for India’s Missing Middle.” A strategic plan is needed under Ayushman Bharat for addressing this issue.

With the recent advancements in technology, the Ayushman Bharat Digital Mission aims at digitizing healthcare. The upcoming budget is expected to support this mission with subsidies and tax waivers.

5. Consumers

The online and offline consumer markets in India simultaneously became more interdependent and competitive at the same time during the pandemic. While app-based home delivery consumption became the go-to option for middle and high-income groups, many local brick-and-mortar shops also adapted to this change by adopting digital technology.

The best strategy for supporting this change is to reduce licensing and documentation requirements and establish uniform regulations for retail across the whole country.

Tax incentives and subsidies to small-scale Kirana shops will be beneficial in modernizing them in terms of digital technology.

In addition to this, investments in the formation and up-gradation of supply chain and logistics infrastructure are also required and will enable India to gain a more noticeable presence in the international retail markets.

6. Micro, Small, And Medium Enterprises(MSME’s), And Fintech

The small and medium enterprises looking to actively scale up their businesses and grow beyond the pre-covid levels are facing problems related to high input costs. An increase in the prices of raw materials especially through artificial jacking by the domestic suppliers is a major concern that the SMEs want the budget to address. An increase in the working capital limit for the MSMEs and a decrease in the GST rates are some of the other expectations.

Many of the startup founders believe that the pandemic has brought in many innovative and new-age tech startups which have been in a true sense the key driver of economic growth. Fintech startups and NBFCs want the government to ease the liquidity flow, relax regulations and liberalize taxes to foster the spirit of digital transformation and financial inclusion.

Conclusion

There are always things that can be improved and sectors that can be further assisted. Some of the issues that are now coming to light in discussions among experts are those related to increasing consumption to pre-pandemic levels, the adoption of growth-oriented reforms, and policies aimed at reducing economic inequality.

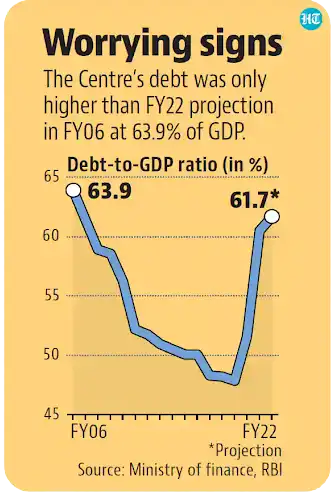

There is also a tendency across media networks to focus exclusively on growth strategies and policies stimulating the economy. Seldom do they draw attention towards rising deficits and the ever-increasing public debt. However, in the long run, these are the most significant in determining the fate of an economy.

References

Author: Arnav Mathur and Dhruv Vasudeva

Illustration by: Arab Kansal and Sai Aditya

Comments